Throughout the past 18 months, ICOs have shifted from a simple and promising funding mechanism into a largely controversial tool that is often used by people with ill intentions, due to the lack of regulations in some jurisdictions. With ICOs, investors are not granted any rights at all and the token issuers do not have any obligations towards their investors. Clearly, the cryptocurrency space was screaming for an alternative funding model.

In the minds of many well respected individuals in the space, the solution may come in the form of Security Token Offerings (STOs). Security tokens are a blockchain-based representation of the ownership of an asset subject to securities laws (for example: shares in a company), and they may prove to be one of the greatest funding mechanisms created to date. In this article, we will extensively cover how to structure a PR and marketing plan for an STO, we will also share many helpful tips and points to keep in mind.

The ultimate guide to STO Marketing and PR

Before getting started

- The difference between ICO and STO marketing

- Define your PR and Marketing goals

Key elements of an STO PR and marketing plan

- The importance of a strong website

- Compliance as a marketing strategy

- Prepare a detailed content plan

- Generate awareness through PR

- Build a strong social media presence

- Start a newsletter to keep investors hooked

- Seek support from industry experts

- Get on podcasts and youtube interviews

- Attend Blockchain and Cryptocurrency conferences

- Pick the right partner exchanges and investors

Last but not least

- Post STO Marketing

About us

- What is PolyGrowth and how we can help

The difference between ICO and STO marketing

If you are planning to conduct an STO, you should be aware of the significant gaps between ICO and STO marketing characteristics. In ICO marketing campaigns, a very common goal is to convince a large pool of retail investors to participate in a public crowdsale. This can be achieved through community driven strategies, like operating a bounty campaign, maintaining several social media channels or running a big telegram chat.

Retail investors are usually low net worth individuals that don’t focus too much on regulatory aspects, a well-considered business plan or other due diligence related aspects. They are mostly on the look for interesting ideas, a decent team, an aesthetic website and a promising roadmap.

The world of security token marketers looks a lot different. STOs are occasionally not allowed to work with conventional retail investors, due to regulatory limitations in many jurisdictions. In the United States, the legislation prohibits non-accredited investors from participating in most types of security token offerings. As a result, the marketing strategy of a security token issuer should be largely geared towards sophisticated and accredited investors.

Sophisticated investors are often well educated in traditional finance related topics and usually have either a high recurring income or a capital pool that is well above average. They insist on careful due diligence and won’t jump on board because of a fancy website or a celebrity endorsement.

The importance of a strong website

Your homepage is the face of your company. Although it won’t be the key element to achieve confidence of customary STO investors, it will often be the first interaction that investors make with your firm, and first impressions matter. Having a professional and informative homepage should be the first step before thinking about an aggressive PR or marketing strategy.

“When creating a website for your STO, don’t forget your target audience.”

An excellent website answers most questions a potential investor could have. It should also be structured in a clean and simple way, it often makes sense to incorporate graphics or a video. Don’t forget your target audience. You don’t want to be wasting the attention of potential investors with unnecessary animations, “countdowns” and the like.

It’s also crucial to incorporate a press section that showcases previous features of your company in the media. This practice proves that journalists (and hence, usually also the general public) are interested in your company, the problems you are trying to solve or your industry in general. The PR section of your homepage should also include an easy way for journalists to get in touch with management or your PR agency.

Finally, you can’t get past high quality investor documents, including a detailed and technical white paper as well as a pitch deck and other elements that may be important for your business. Be sure to take these steps very seriously, otherwise the attention and traffic generated by your PR campaign might not be converted as well as it could be if there was an excellent website.

Brag about your compliance

We will keep things very top-level in this section since this is a topic that you should discuss with your legal team.

As mentioned earlier, STOs are very different from ICOs in regard to the type of investor that is being targeted. ICOs usually target retail investors. This target audience puts less effort into due diligence and legal aspects since they (usually) don’t have a professional investment background and are not very familiar with compliance requirements.

On the other hand, STOs target institutional investors. This target audience will not invest in a deal that doesn’t have a clear legal structure and is compliant with all relevant rules. They will rather pass on investing in your STO than risking an investment if they are not 100% sure that regulatory requirements are met.

Therefore, when launching an STO it’s not only crucial to get your compliance right, but it’s also important to make the necessary documentation easily available to investors. Again, you should discuss this with your attorneys, but a first step could be to list all relevant disclaimers, terms, legal firms you worked with etc, in a specific section of your homepage that is dedicated to compliance.

Define your STO PR and Marketing goals

Before getting started with your marketing strategy, you need to have well defined goals. Otherwise you will be marketing blindly, which most often leads to underperformance.

Is your goal to attract new investors? Is it to get new users onto your platform or to attract clients? Do you just want to generate general awareness? Are you rebranding and you want to let everyone know?

Try to reduce your list of PR and Marketing goals to a maximum of four to five items, otherwise it might not be realistic to achieve them.

“The first question we ask new clients is: What do you want to achieve with your PR campaign?”

After you clearly defined your goals, you now need to explore who exactly you are “talking” to. For example: If your goal is to onboard investors, then you need to know exactly which type of investors (investment niche, geographic location, average deal size etc). The exact approach to reach your PR goals (journalists you contact, podcasts you join, conferences you attend etc) only depends on who you are trying to talk to.

If you are working with a good PR or Marketing agency, then this section should be mostly taken care of by the firm. However, you will still have to give the PR agency a solid starting point since they can’t blindly guess what it is that you are trying to achieve.

Prepare a detailed content strategy for your STO

As we state on the PolyGrowth homepage: “Content is the voice of your brand.”

Blog posts and in-depth articles enable you to prove your knowledge to the entire world, while simultaneously educating readers through your own personal stories. We ALWAYS advise companies and start-ups to maintain an active company blog that provides development updates and educates the community about your industry or niche. Just 2 articles a month can be a true game changer for your growth strategy. It’s very straightforward to set-up a blog and shouldn’t take longer than an hour. You can use self-hosted solutions like WordPress.org or third parties like Medium and Steemit.

A dilemma some may face when setting up a blog is thinking that it won’t receive any traffic and that it will only be a waste of time. That will be true for the first 3–5 months of the existence of your blog, but it will eventually be noticed if you produce high quality content.

“Blogs first grow very slowly, and then they explode.”

That being said, if you want to have faster results, it could make sense for you to publish your articles on third-party blogging platforms, like Medium and Steemit. This can instantly give your content exposure to millions of avid readers. The blockchain platform Steemit features a rebellious vibe and is mostly used by cryptocurrency enthusiasts. Medium can be considered as a rather professional medium and exposes its content to a more general readership. Choose accordingly, depending on who you want to reach.

Aside from that, a YouTube channel could be an additional tool that you might want to look into. Especially for younger generations, videos tend to be more persuasive than most ordinary write ups. Featured topics could be detailed presentations, animated explainers, updates and presentations at conferences.

Finally, to wrap this section up, if you are acting in the security token world, it will make sense to familiarize yourself with search engine optimization (SEO). The space is still in its infancy and chances are high that you will be able to dominate certain keywords on major search engines. This can bring you a steady flow of highly targeted, organic traffic.

Generate awareness through PR

Being featured on various media publications is essentially key to every successful PR campaign.

Over the past year, the blockchain and cryptocurrency world became a very noisy space. The constant flow of company announcements, news (which are often only partially correct), partnership announcements and technical breakthroughs can make it very hard for a small start-up to stand out.

“We are living in a world full of display ads, sponsored content and promotional emails. Ironically, it has never been harder to effectively reach a consumer.”

This is where a strategic PR campaign steps in.

When holding a security token offering, there are three types of media outlets that should be of interest to you. Priority number one are often finance and business publications, like Forbes or the Financial Times, that come with a certain prestige and reward your project with instant legitimacy. Those magazines are often read by entrepreneurs, well informed investors and other like-minded people who could become potential investors or future collaborators.

INFO: With our recently founded platform getonforbes.com, we aim to help you getting featured on Forbes swiftly and efficiently.

Secondly, there are cryptocurrency focused platforms, such as CoinTelegraph and CoinDesk. Since STOs are often still happening in the cryptocurrency context, they may prove to be an audience of immeasurable importance. The readership of cryptocurrency journals certainly consists of a big number of retail investors, but they are also read by blockchain-related business owners and large investors who are trying to keep abreast of new developments in the space.

Last but not least, technology orientated publications like WIRED and Mashable should also be considered. While they might not represent the most significant section, it can still be a smart move to get featured on them. Tech blogs and magazines are frequented by a large mix of potentially interesting audiences, like developers, entrepreneurs and tech-oriented VCs.

In a noisy space like the cryptocurrency and blockchain ecosystem, an aggressive PR campaign should be a core component of your growth strategy.

Build a strong social media presence

In today’s world, cultivating a strong social media presence is an obligation for every business with an online presence. Crypto related companies generally do a very decent job in this area, as most ICOs maintain at least five social media accounts. That being said, upcoming STOs should follow a slightly different social media strategy than a conventional crypto crowdsale.

As a security token issuer, you will first want to make sure that you cover all professional networks. This includes a Twitter account, a LinkedIn and Facebook page, and possibly a YouTube channel or Medium account. Chat applications like Telegram or Discord might be interesting in very rare cases as well, but most of your investors will probably prefer to stay in touch via email or phone. Forums, such as BitcoinTalk and Reddit, can be useful for establishing communities, but they will have a negligible impact on your quest for STO investors.

In order to grow these channels properly, you need to stay active and engage with other users. Try to share updates or valuable information at least twice a week, posting once a month won’t do the job. Engage with other companies and users, answer good questions and try to spread a positive vibe. Especially on Twitter, it can be very powerful to interact with users who are not your followers yet.

If you get a comment or inquiry, don’t let your conversation partner wait too long. Large followings on social networks come with an increased reputation and should be the goal of every company. With that in mind, you should also consider hosting community building events from time to time, like webinars and AMAs. This community may not directly have an impact on your STO since they likely won’t invest, but if it feels identified with your goals and vision, it can be a very loud voice that can amplify your marketing message by several magnitudes.

Start a newsletter to keep STO investors hooked

Many traditional firms put a lot of effort and capital into acquiring customers, they launch expensive PPC campaigns, influencer marketing and PR efforts. However, they often don’t have a strategy in place to retain a potential client after he has already expressed his interest. This results in leads that go cold and low conversion rates.

Email marketing has been the golden goose for online marketers for over a decade, and it should also be at the core of your STO Marketing and PR campaign. Having a weekly or bi-weekly newsletter is crucial for retaining interested investors and for growing your network through clever thought leadership.

The power of newsletters arises from the fact that they are inherently personal, even if they are not personalized, because they arrive in the inbox of your subscriber and speak to his interests. This effect is enhanced even further due to the target audience that you are trying to speak to. As mentioned earlier in this article, STOs target a different audience than ICOs do. The people interested in your offering likely don’t use social networks like Reddit as their preferred source to stay updated, they mostly stick to their inbox instead.

The New York Times, a publication with 14 million email subscribers, is widely known to use clever newsletters to convert readers into paying subscribers. The newsletters are purposefully structured in a habit-creating way, which increases the likelihood of subscribed readers purchasing a paid NYT subscription by over 100 percent .

How can you apply the same tactic to your security token offering? There is no simple answer to that; it depends on your product or service, the details of your investment offering (geography, size etc), and your past track record and reputation. There are 3 main angles from which you can approach your newsletter:

- Regular updates. In this type of newsletter you would be sending a weekly or bi-weekly email to your subscribers to summarize what you have been working on, what you achieved and to share any other interesting developments. Investors and community members value transparency a lot, sending regular progress email updates is the best way to showcase that transparency is important to you as well.

- Educational. In this case your goal is simply to educate your email subscribers. Share an analysis of your industry, explain key terms and concepts of the business you operate in and explain how your product/solution is different from your competitor’s.

- Thought leadership. Finally, you can also use your newsletters to show your subscribers that you are an expert in the area in which you are operating in. In this case you would be sharing your opinion about the industry that you are operating in, performing detailed analysis of where the industry might be headed and cover other relevant topics.

The solution to crafting the perfect newsletter is not just picking one of the three options above, but combining them in a clever way in order to maximize engagement and impact. It can be very helpful to be assisted by an external third party that helps with the creation of a solid newsletter strategy. This helps you to prevent issues related to personal biases and preferences.

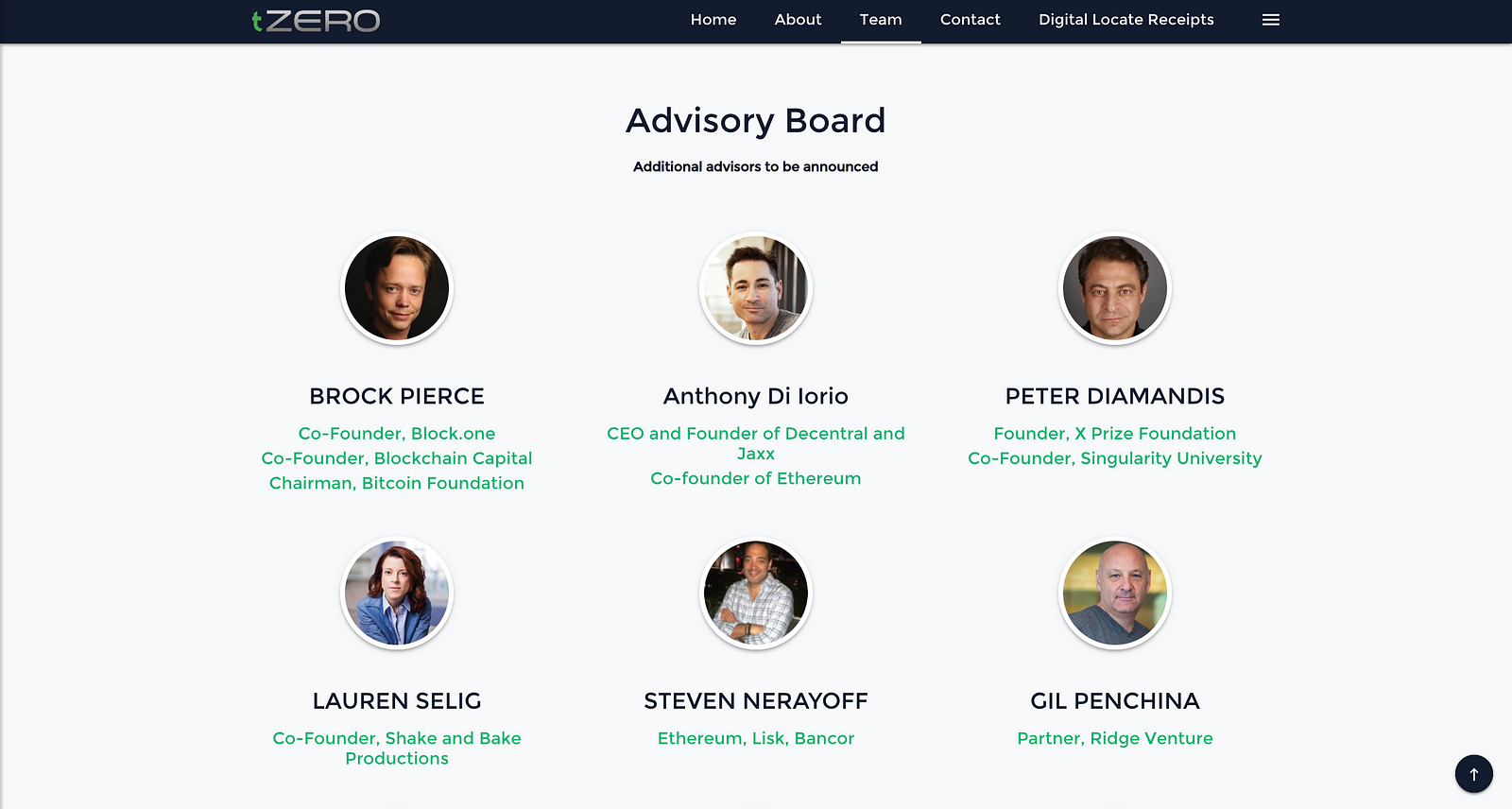

Seek support from STO industry experts

Security token issuers are true pioneers of the finance world, no matter what goal they are actually pursuing. However, early adopters often face an unbelievable amount of obstacles that could potentially hamper their business. In the current state of the STO market, it is very challenging to make meaningful progress without the advice from various specialists in the topic.

The space inheres many challenges on the legal side, technical hurdles that come along with programming secure tokenized securities and, of course, the task of properly marketing the offering. Advisors can definitely bring a lot of value to your company. Not only in the form of knowledge and advice, but often also in the form of industry connections. There are mainly three options to consider when looking for the right advisors.

“Advisors can make or break your security token offering. Choose wisely.”

The first one, which is also probably your best bet, is to look for activists and influencers within the security token space. Attend security token events, look for known enthusiasts on social networks or contact authors of relevant articles that you found intriguing. The most valuable advisor will be one that has already worked with STOs in the past or one that has held one himself.

Although most big names in the space are mostly using Twitter, you shouldn’t fully dismiss LinkedIn when on the look out for advisors. From our personal experience, this method is comparatively simple yet highly effective. Through LinkedIn outreach, you can establish diversified connections that include all of the three important advisor types (marketing, legal and technical). In contrast to approaching popular “celebrity” advisors on Twitter, you are also more likely to get a response.

Last but not least, you shouldn’t forget to leverage your personal network. You might be surprised how large your network of second degree connections is.

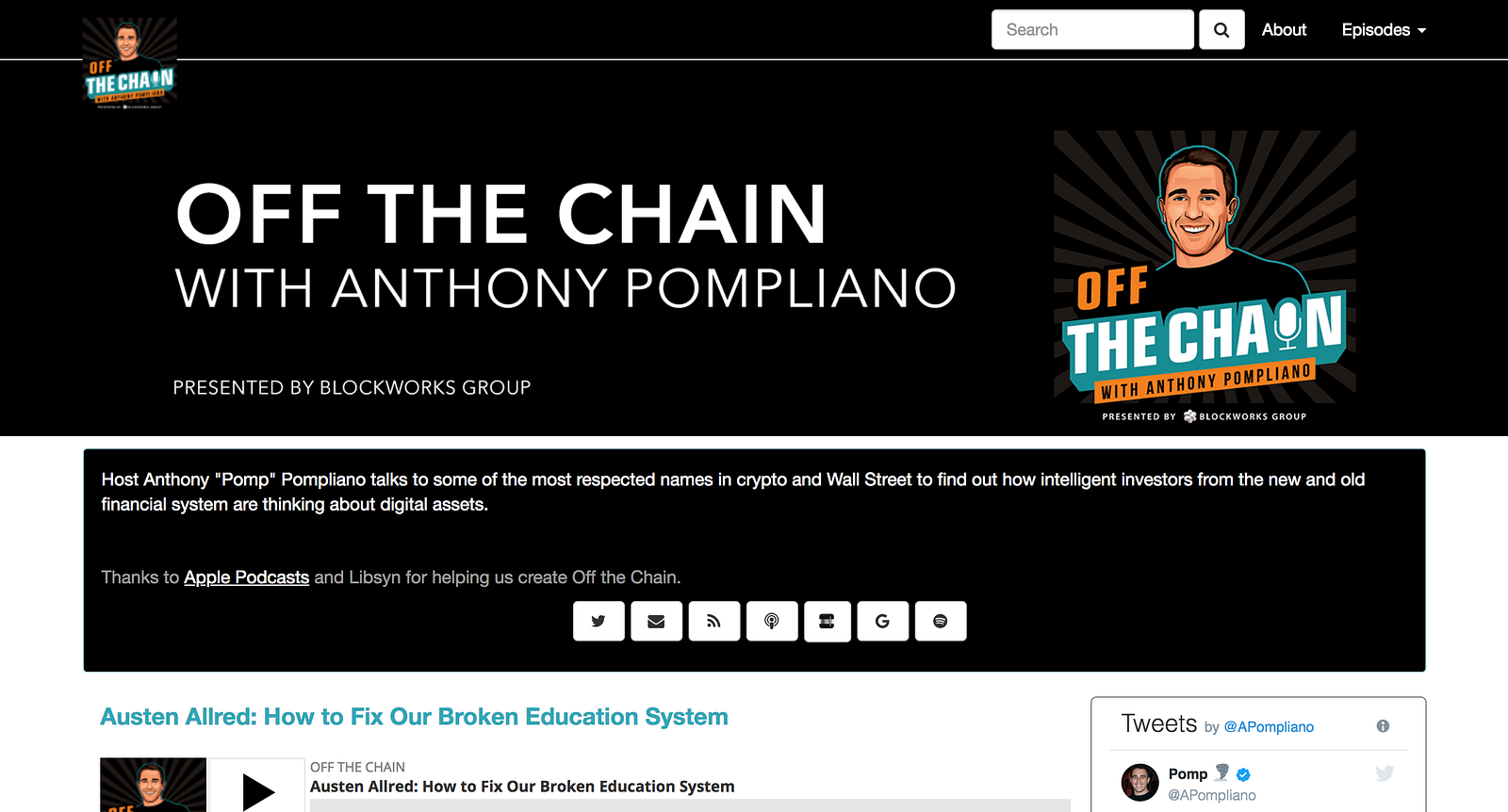

Get on podcasts and YouTube interviews

Your content strategy should not only be focused on written articles. An interesting report by WordStream claims that one third of all online activity is spent watching videos — over half a billion people watch a video on Facebook every day — and that videos on a landing page can increase conversion by 80% or more.

Especially in the cryptocurrency space, the audience is currently composed of a younger demographic, videos and podcast interviews can have a powerful impact. Wisely combining both will let you reap the greatest results: podcasts are a timely content medium that is often consumed by busy VCs who don’t have time for other forms of content and youtube videos are usually consumed by younger audiences.

Preparing an exceptional pitch is a basic requirement if you want to join a podcast or youtube show. Otherwise, expect to pay a hefty fee to be invited to a “sponsored episode”. From our experience at PolyGrowth, sponsored interviews on major youtube channels or podcasts will cost north of $10,000, sometimes reaching into 6 figures.

Keep the pitch simple and powerful. Here’s a structure that you can follow:

Hello ___,

My name is ___ and I’m ___.

I found your podcast/youtube show by ___ and I think that your audience could be interested in my story.

– Point 1 why my story is interesting

– Point 2 why my story is interesting

– Point 3 why my story is interesting

Keep up the great work ___.

All the best,

____

If you are still a relatively unknown company or start-up in the space, you will be rejected or ignored countless times, persistence is key in this game and you will eventually get invited on a show if the host sees how you can add value to his audience.

Attend blockchain and cryptocurrency conferences

We live in a world in which a large part of our daily communication has shifted to online mediums like email, twitter and messaging apps. While these provide great ease of use and help us reach an exponentially larger audience than we could reach by “offline communication”, it has also lead to personal communication becoming more powerful than ever.

There are only a handful of ways in which blockchain companies can connect with their communities in a very direct manner and attending industry relevant conferences is definitely on the top of that list.

“In industries with many bad actors, you can stand out by showing your face.”

By attending crypto conferences you can:

- Improve existing relationships. By attending cryptocurrency conferences or meet-ups you have the opportunity to connect in person with some of the online relationships that you have formed in your community. Online communication is good, having a 5 minute chat in person is enormously powerful.

- Establish new connections. Pretty straight forward, at conferences and meetups you get the chance to meet other like-minded people who might be interested in investing into your STO deal or who know someone who might.

- Increase trust. Making a public appearance gives investors the chance to put a face to your STO. This is especially important in industries like the blockchain space where there have been many cases of fraudulent projects with “faked” teams running away with investor funds.

- Generate high-quality video material. By recording your presentation at a conference you are creating valuable marketing material. You can use these videos to share them in your newsletter, to add them to a section on your website or even to pitch them to journalists. If you covered a topic of general interest in your presentation, you should also upload it to video platforms like YouTube with a highly SEO optimized title and description. This can drive surprisingly large amounts of organic traffic to your social media channels and your website.

That being said, it can often be extremely hard to get a speaker slot at a top blockchain or cryptocurrency conference if you aren’t exactly an influencer in the space with tens of thousands of followers, or if your company has not yet publicly achieved any groundbreaking results.

When reaching out to these conferences, it’s important to put a lot of effort and thought into the pitch. Focus on a brief intro to the most interesting parts of your professional background, mention 2–3 amazing things that your company has achieved and, finally, also list 3–5 topics that you could talk about and briefly mention why attendees will be HIGHLY interested in them.

If you can attach a video of a previous presentation that you held at a major conference, that’s a huge plus, if you can also get an intro to the conference organizer by a connection of yours, that’s even better!

Some conferences will ask for a fee to attend as a speaker. Generally, that is OK, the organizers need to cover their costs after all. However, you need to be very careful with whom you send your money to. There are many “money grab” cryptocurrency conferences that will charge you $10,000 for a speaker slot. What might sound like a fair deal at first can turn into a large deception when you arrive at the event and are presenting to an audience of 30 people and all other speakers are also just trying to promote their product or investment.

One simple way of avoiding these lower tier conferences is by looking at the speakers list. Are there any respected names on there? If not, you should probably stay away.

Pick the right partner security token exchanges and investors

One of the largest value propositions of security tokens is that they can bring liquidity to markets that used to be highly illiquid. Blockchain technology makes exchanging fractional ownership of illiquid assets like real estate or PE fund equity easy. However, there’s a catch. For many assets the value add will only fully manifest itself if the security token is listed on an exchange that can provide simple access and a large user base of investors.

At the time of writing, it’s still very early for security token exchanges and there aren’t many to choose from. Some of the major players in the space are tZero, Open Finance Network, and BnkToTheFuture. It should be a priority to reach out to all exchanges that you want to partner with as soon as possible, since it can take a long time until you hear back from them.

In the words of Andy Singleton, CEO of Aboveboard and one of our clients at PolyGrowth:

“It is not easy at all to get these meetings.”

After you reached an agreement with a security token exchange, you should consider adding this to your investor pitch deck and including it in your marketing message. Investors like to hear that they are investing in a deal where there will be enough liquidity for a potential exit after some time.

In addition to choosing the right exchange partner, it’s also important that you pick the right investors if you are in a position where you can afford to do this. Investors that are well connected in the space and have a track record of advising companies in their previous deals will be able to add significantly more value than just a lump sum of money.

Post STO marketing

Eventually, if things go as planned, the day on which you hit your funding goal will come and then you can now go full steam ahead with developing your product or growing your business. Especially after the ICO craze, many teams went into “stealth mode” and stopped making announcements, sharing company updates or communicating with their community. In the eyes of the public, that’s a dead project and it will be very hard to build up public excitement again.

“Being busy building your product is not an excuse to neglect marketing and communications.”

After finalizing your STO, marketing efforts should still be a core component of your overall strategy. Build on the attention that you already generated prior to your security token offering, don’t let it die off. If you haven’t already started a weekly newsletter, or an active content strategy where you publish a blog post once a week, then now is the time. Let investors know how you are progressing and remind them of your vision from time to time, they will appreciate it greatly and will stick around to make some noise when you are ready to launch your product.

Once the date of the product launch comes closer, it will now also be time to reignite the PR engine. Start spreading press releases again, talk to journalists, join podcasts and speak at conferences. Let the true fireworks begin.

What is PolyGrowth and how we can help

PolyGrowth is a PR agency focused on cryptocurrency and blockchain companies. The firm has worked with several major players in the space, including security token platforms like Aboveboard.